The Agency Brokerage – Ten centuries of evolution

In the first of a new column focused on agency brokerage, reporting on the impact of market trends, technology and regulation, we look at the history of the broker.

By Gherardo Lenti Capoduri, Head of Market Hub, Intesa Sanpaolo – IMI Corporate & Investment Banking

By Gherardo Lenti Capoduri, Head of Market Hub, Intesa Sanpaolo – IMI Corporate & Investment Banking

A broker is universally recognised as an independent party, whose services are used extensively across industries, not only in finance. A broker’s prime responsibility is to bring buyers and sellers together as the third-person facilitator of a trade. Brokers may represent either the seller or the buyer, but generally not both at the same time and at the same price. Brokers are almost always necessary for the purchase and sale of financial instruments. They are expected to have the tools and resources to reach the largest possible base of buyers and sellers across a broad range of global financial markets. Brokerage firms are generally subject to regulation based on the type of brokerage and jurisdictions in which they operate.

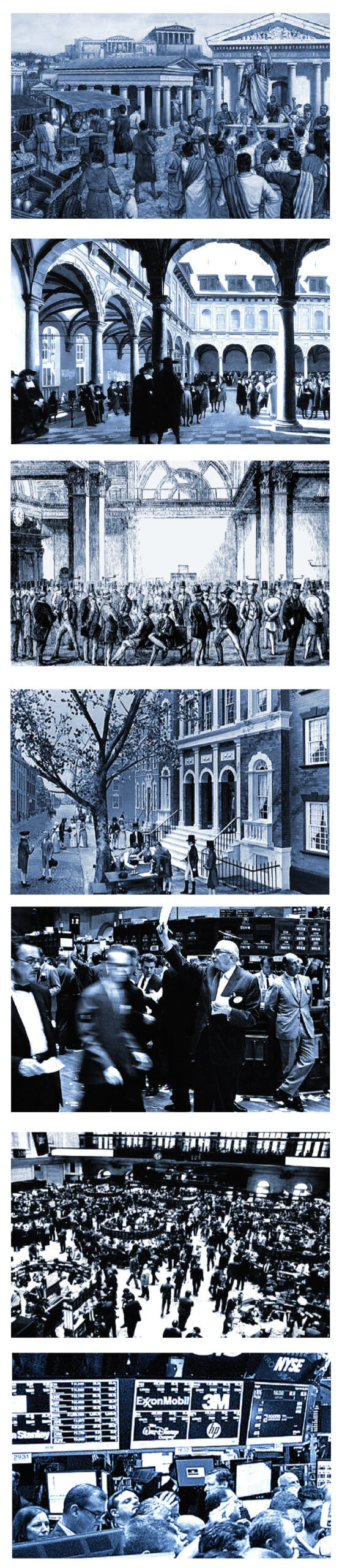

Stock brokerage firms have been an established feature of the financial industry for nearly one thousand years. As an institutionalised profession it dates back to the 2nd Century BC in Rome. However, after the collapse of the Roman Empire, the profession remained obsolete until the European Renaissance. During the eleventh century, the French began regulating and trading agricultural debts on behalf of the banking community, creating the first brokerage system. In the 1300s, houses were set up in major cities like Flanders and Amsterdam in which commodity traders would hold meetings. Soon, Venetian and Genoese brokers began to trade in government securities, expanding the importance of the firms. In 1602, the Dutch East India Company released the first publicly traded stocks through the Amsterdam Stock Exchange and started to issue stocks as a means to spread the investing costs and risks. Owing to the law of private property rights indoctrinated in the Dutch Empire, the profession of stockbroking flourished.

At the end of the 17th Century, the London Stock Exchange came into existence, and almost a hundred years later, in 1792, the New York Stock Exchange was formed and various firms like Morgan Stanley and Merrill Lynch came into existence to assist in the brokering of stocks and securities. The firms limited themselves to researching and trading stocks for investment groups and individuals. India and Asia saw its first Stock Exchange the Bombay Stock Exchange, open in 1875.

During the 1900s, stock brokerage firms began to move in the direction of market makers. A broker-dealer is a broker that transacts for its own account, in addition to facilitating transactions for clients. They adopted the policy of quoting both the buying and selling price of a security.

Before Wall Street was ‘Wall Street’, there was a buttonwood tree. And on 17 May, 1792, twenty-four prominent brokers gathered around the tree to sign its namesake agreement. The Buttonwood Agreement marked the birth of the organised financial market in the US, setting the standard commission at 0.25% and paving the way for the modern broker, an individual with the sole purpose of facilitating financial instrument transactions.

Before Wall Street was ‘Wall Street’, there was a buttonwood tree. And on 17 May, 1792, twenty-four prominent brokers gathered around the tree to sign its namesake agreement. The Buttonwood Agreement marked the birth of the organised financial market in the US, setting the standard commission at 0.25% and paving the way for the modern broker, an individual with the sole purpose of facilitating financial instrument transactions.

The invention of the telegraph in 1844, the transatlantic cable in 1866, and the telephone in 1876 revolutionised communication all over the world and opened new doors of opportunity for financial institutions.

These new technologies sparked more efficient and immediate communication between markets, allowing for more apt pricing by increased market size and available information.

Five years after the stock market crash of 1929, President Roosevelt’s administration enacted a new set of laws regulating trades within the stock market in an effort to curb future financial crises.

Born out of the belief that reckless practices within the financial industry caused the crash, the Securities Exchange Act of 1934 created a new regulatory body, the Securities and Exchange Commission (SEC), to promote transparency, accuracy, and fairness while curtailing fraud within the industry.

More recent brokerage history has been characterised by a rapid globalisation of financial markets, financial democratisation and financial culture spread wide. On one side we saw the creation of massive financial institutions, global brokers, that valued, held, sold, insured, and invested in securities while on the other side were smaller regional brokers taking control of smaller financial clients and individual investor accounts, giving access to a wider number of people, adding liquidity to the market, increasing financial markets accessibility and offering a variety of investment solutions.

More recently still, the availability of computers allowed financial institutions to broaden their investor base and provided more effective communication between markets, paving the way for online brokerages offering cheaper and simpler trades for anyone with a computer or telephone access. The 2010s began with technology sprinting forward at a seemingly exponential rate, with smartphones continuing to build on the advances of computers from previous decades. Robo-advisers, which first entered the scene in 2007-2008, began to thrive, offering consumers lower fees, intelligent automation and more flexibility.

More recently still, the availability of computers allowed financial institutions to broaden their investor base and provided more effective communication between markets, paving the way for online brokerages offering cheaper and simpler trades for anyone with a computer or telephone access. The 2010s began with technology sprinting forward at a seemingly exponential rate, with smartphones continuing to build on the advances of computers from previous decades. Robo-advisers, which first entered the scene in 2007-2008, began to thrive, offering consumers lower fees, intelligent automation and more flexibility.

The financial crisis of 2008 led to a rapid transformation of the brokerage industry and trading behaviours, with two main drivers: regulatory architecture changes and technological innovation.

In Europe, financial markets infrastructure is being reshaped following the end of the exchange trading concentration obligation under the first Markets in Financial Instruments Directive (MiFID I) and the creation of new regulated trading venues.

While in USA the alternative trading system (ATS) numbers and volumes are increasing, in Europe we are now witnessing an aggregation process among exchanges and the reduction of over-the-counter (OTC) business following the restrictions introduced by MiFID II.

The traditional relationship model between clients and brokers is changing with the rise of alternative trading systems and new market protocols – driven by increased transparency, more operational efficiency, less portfolio risk, multi-asset and multi-markets logic and more financial services – in addition to pure order execution.

Market data is another major topic for brokers and their clients, with a need to aggregate markets and data providers globally in order to create synergies in data distribution.

The Covid-19 emergency and proliferation of smart working is now giving a major boost to automation and efficiency in order processing, in messaging tools, in virtual networking and in compliance monitoring systems. New capabilities in managing the workforce and new trading behaviours are in the forefront of this transformation. This evolution demands strategic solutions and huge amounts of capital for innovation.

©Markets Media Europe 2020

TOP OF PAGE

By Gherardo Lenti Capoduri, Head of Market Hub, Intesa Sanpaolo – IMI Corporate & Investment Banking

By Gherardo Lenti Capoduri, Head of Market Hub, Intesa Sanpaolo – IMI Corporate & Investment Banking