Onwards and upwards

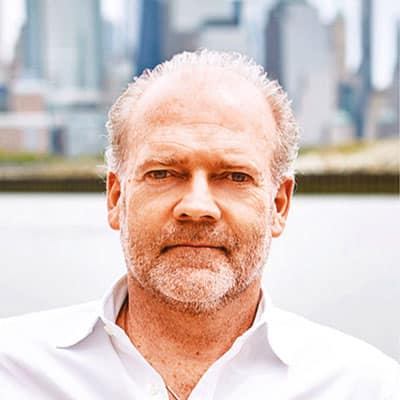

Alan Schwarz, co-founder and CEO of FXSpotStream spoke with Best Execution about their strategy amidst the growing demand for algos in FX trading.

Alan Schwarz, co-founder and CEO of FXSpotStream spoke with Best Execution about their strategy amidst the growing demand for algos in FX trading.

FXSpotStream has seen consistent growth in total trading volume and the ADV since the start of 2021. What are some of the drivers?

In 2020, FXSpotStream (FSS) registered as the fastest growing eFX service for the third consecutive year, seeing an 18.52% increase in terms of overall volume supported. 2021 has maintained that momentum.

There are many reasons for the growth of our business since our formation over 9 years ago. One of the main reasons is our commercial model. Liquidity Providers (LPs) are charged a flat fee to trade as much as they want, while clients pay nothing to use the Service. The more an LP trades with a client, the lower their “effective rate.” Because our LPs pay less when they use our Service, clients can expect better pricing. We also allow our clients and LPs to interact with each other in a much more efficient and cost-effective manner by connecting physically over one API to various clients in the case of the LP, and 15 LPs in the case of our clients.

In addition to our commercial model, the disclosed nature of the LP and client relationship has also contributed to the growth in our volumes. We continue to see a trend in clients and LPs migrating to disclosed trading as they want to know who they are interacting with at all times. The nature of the disclosed relationship also allows for the parties to address credit, market impact and information leakage concerns.

Last, but certainly not least, we are known for having one of the best customer support operations in the FX industry. Despite our rapid growth, supporting our clients and LPs, including providing a stable technology, remains a top priority. Our 24/5 global support team ensures clients and LPs can focus on doing business with each other while we address their technology requirements in the background.

Earlier in the year, the company said it was going to add several FX Algo strategies, along with FX Allocation services, which will be offered via your API from the second quarter of this year. Can you please provide more detail into what you are going to do?

We are taking the entire algo offering from our LPs and opening it up to our clients, initially over our API. This is over 70 different algos, and 200-plus parameters. We felt that with the growing demand for algos, and the unique requirements of each client, it made sense to normalise the entire suite, rather than trying to pick and choose the LP algos we would offer. In addition, we will be supporting the pre- and post – trade allocation functionality offered by our LPs.

A great deal of work has taken place on our API to support the algos of our LPs. Our aim is always to make the interaction between our clients and LPs as efficient as possible. Clients seeking to access the algos of our LPs will not need to add any additional network infrastructure, connecting in the same way as they do today – accessing a normalised API through a single FIX session that provides access to algos offered by multiple providers.

What have been the drivers behind the expansion?

One of the core values of FXSpotStream is that we continually challenge ourselves to grow every year. In 2020 we began dedicated work to make major functionality enhancements by adding support for algos thus strengthening our offering to current and prospective clients, while also allowing us to target new areas of the market. By supporting algos over our API, we are targeting a gap in the market (with most algos being supported over a GUI) and meeting a growing demand from clients.

How do you see the demand for FX algos increasing?

The automation of the foreign exchange market has seen a strong shift from its roots of telephone trading and voice desks to today’s technological world. Algorithmic trading is another area of the FX market that has seen significant growth as clients aim to obtain a better price and execution, while limiting the risk on their part. Today, Algorithmic trading accounts for approximately 20% of all institutional foreign exchange trading volume and half of all equity trading volume.

Thus far, the demand for our algo offering has been very strong. Automation brings resilience, and with a dispersed workforce resulting from the pandemic there has been a strong call to automate processes, controls and reporting functions. For us, the need to automate screams ‘API’, an area that has always been our strength.

How do you see the rest of the year panning out? Do you expect market volatility to continue?

Yes, we expect to see market volatility to continue as the “reopening” of the world economies is felt and interpreted. As a result, we expect 2021 to be another very strong year for us. In 2020 we saw an 18.52% increase in volume over 2019, and we already see a 14.97% increase in ADV for the period January-May.

We have also continued to add new clients to the Service and have an extremely strong pipeline in all three regions. We are also excited to see the volume growth from the addition of FX Algos and allocations.

What do you foresee as the biggest challenges and opportunities for clients?

The cost to access liquidity remains a challenge as technology continues to become more of a need versus a want. Add the technology cost with the fees charged by third parties or venues to get that access, and clients can struggle to generate returns on the risk they are taking. We are uniquely positioned to help reduce the cost of execution by offering a free service to clients and a more cost-efficient service to LPs. Plus, with LPs paying less to deal with their clients, clients benefit in the price offered by the LPs.

What other projects does the company have in the pipeline?

Later this year we will be adding Algos and Allocations to our GUI. We also have a significant project we are working on that we will announce in Q4 that will offer even greater benefits to our clients and LPs when they use our service.

©BestExecution 2021