THE ROLE OF SYSTEMATIC INTERNALISERS IN MIFID II TRANSPARENCY.

By Geoffroy Vander Linden, Head of Transparency Solutions, Trax.

| With the 25 April 2016 release of the Delegated Regulation from the European Commission, Article 13 now sets out its final proposal for the determination of Systematic Internalisers (SIs) for bonds. The texts states: An investment firm shall be considered to be a systematic internaliser in accordance with Article 4(1) (20) of Directive 2014/65/EU in respect of all bonds belonging to a class of bonds issued by the same entity or by any entity within the same group… |

This is an important distinction from previous proposals and leaked drafts of the regulatory text which has shifted from an instrument by instrument approach, to a class of instrument approach, to the proposed approach in the Delegated Regulation which is now by reference to both class of bond and the financial group of the issuer. An investment firm will be an SI if it trades on a frequent and systematic basis in liquid markets for all bonds in the same class, which are issued by the same entity or by any entity in the same group.

As an example, if an investment firm is deemed to be an SI for a specific corporate VW bond, the firm will be deemed an SI in all corporate bonds issued by any entity within the VW Group, and therefore it shall be subject to all pre- and post-trade transparency (trade reporting) requirements for all corporate VW bonds. A further implication is the requirement for SIs to provide its competent authority with reference data relating to financial instruments (e.g. VW bonds) admitted to trading or traded on its system.

What are the challenges?

A particular challenge of the 25 April Delegated Regulation will be the ability to determine what issuers form part of the same “group”. For the purposes of MiFID II, a “group” is defined by reference to the Accounting Directive, which includes (broadly) a parent undertaking and all its subsidiary undertakings. Group structure information is not readily publically available for all entities worldwide and even where it is available, it is not necessarily accurate. It will be very difficult for any firm to ascertain this with any reliable certainty and manage this information.

Taking the example above for VW – a quick glance on the VW website indicates that in addition to the twelve car brands, the group engages in a range of commercial businesses including financial services, within the VW umbrella. This example helps demonstrate the complexity with which corporations and their related entities may issue debt and thus the required data management burden.

The need for sophisticated solutions to help participants manage this level of complexity will be fundamental to ensuring regulatory compliance.

What’s the potential impact?

While it’s difficult to predict how the market will react once MiFID II is implemented, it’s reasonable to assume that investment firms will:

- carefully review their trading behaviour in any one particular bond to limit any unnecessary market exposure as a result of becoming an SI in all relevant bonds of the same issuer, as well as;

- extend that caution to the trading behaviour in relation to the financial group of that issuer, regardless of whether or not the different entities in the group are active in the same business sector.

One thing is certain, the proposed rules present greater operational complexity in meeting the challenge of determining SI status.

Accordingly, it is very difficult to predict whether or not the rules shall result in more or less SIs than would have been the case under an instrument-by-instrument determination, or even by a class of instrument determination. Presumably, it will result in less SIs than would have been created under the class of instrument proposal.

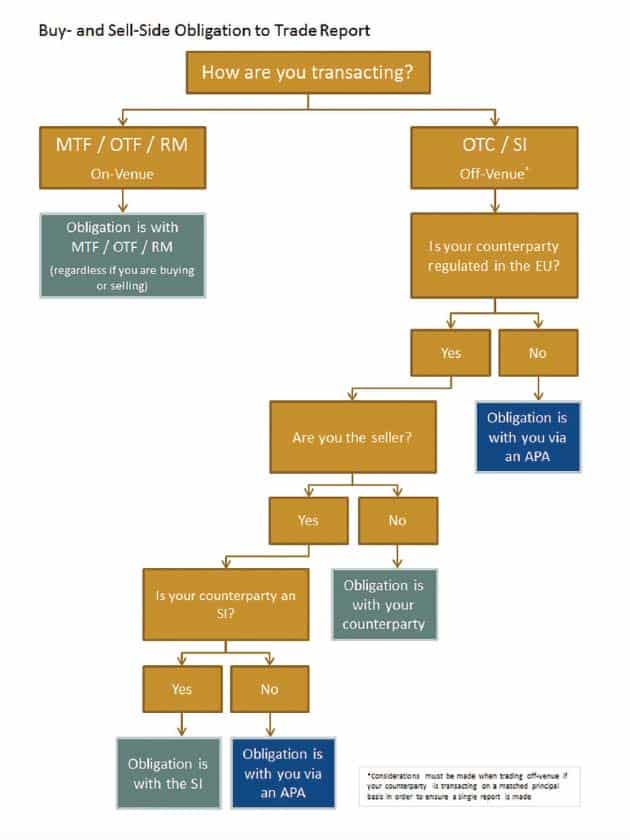

Importantly, given the consequent lack of clarity on the number of firms that will become an SI, market participants cannot assume that that bond markets will be flooded with SIs to take on the trade reporting obligation. It is therefore even more critical for all buy- and sellside participants to ensure they have relationships with Approved Publication Arrangements (APAs) to ensure they meet their transparency obligations under MIFIR. The workflow diagram indicates the trade reporting process for buy- and sellside firms.

What next?

It’s critical that all market participants understand how MiFID II will impact their business and take action to implement the necessary processes to meet their regulatory obligations. At Trax, we are working closely with the industry to ensure readiness ahead of the expected 3 January 2018 MiFID II implementation date.

We launched the Approved Publication Arrangement (APA) Demonstrator, a validation engine that provides an early opportunity for firms to view the effect of the MiFID II trade reporting regime. We have also developed further transparency solutions such as SI determination tools to assess whether a firm would be an SI at instrument level and to what extent a firm would be subject to pre- and post-trade reporting as well as reference data reporting obligations.

This article was first published online in the MarketAxess and Trax, Capital Markets Forum: www.capitalmarkets-forum.com

©BestExecution 2016

[divider_line]